Dr. Salman Ghouri

and Dr. Yumna Ghouri

Fossil fuels

have been the dominant source of energy for global economic prosperity for over

150 years and today still accounts for over 86% in global energy mix. The

question is what would be its role during the next 2 to 4 decades? There is an on-going

debate among various agencies, researchers and academia whether the role of

fossil fuels will significantly diminish. It is quite possible that things

might change drastically during the next 2 to 3 decades owing to technology,

severe climate change and transformation of our mind-set. In today’s world the

speed of technological

innovation is in seconds compared to

decades in the past (comparatively terms). The

innovation in fuel cells, electric cars, NGVs, significant decline in cost of

solar and wind power during the last decade turn out to be great challenges for

oil and gas industry. The question is how big a share of fossil fuels will be

taken up by renewable sources by 2040? Is this share substantial enough to

undermine the role of oil and gas industry?

In order to explore the

possible answer this paper forecasts the total primary energy consumption in

North America by 2040 (such forecast can be carried out for other regions at a

later stage). In order to estimate consumption behavior we have to develop econometric models for oil,

natural gas, coal, nuclear, hydro and renewable energy using respective prices,

GDP, population, trend variable with and without constant in order to find the

best estimated relationship for each of the energy resources. Different

models are required to explain the behavior of each of the energy resources as

one model cannot explain the consumption pattern for all forms of energy

resources, because of the importance in consumer’s budget and its usage. The

consumers are generally constrained by habit, technological and other factors,

such as a regulatory barriers; therefore response to a price change, or change

in technology e.g. availability of electric cars, NGVs, fuel cells, is weak in

the short-term. However it will strengthen over time. To capture this lag

structure we have used a polynomial distributed lag model (Almon model) to

estimate the respective energy demand. We have also run autoregressive and

moving average wherever necessary in order to correct the autocorrelation

problem. The best-fitted model has been used to forecast respective energy

demand by 2040 under alternative scenarios.

Historical data have

been drawn from various sources. For instance, regional historical energy

consumption is drawn from BP Statistical Review of World Energy June 2015. GDP (current

prices) and population data is extracted from IMF reports and energy prices

from the Energy Information Administration (EIA) reports. In order to forecast

energy demand we used the GDP and population growth assumptions (shown in Appendix

-A). Future forecast of energy prices - oil, natural gas, coal and electricity

(though electricity prices vary from consumer to consumer; residential,

industrial, commercial, transport, we have used total electricity prices) are derived

from the EIA. For low and high case scenarios we have assumed GDP and population

will grow at an annualized rate as highlighted in Appendix-A.

North America TPEC - 2014

In order to comprehend the market it is useful to briefly

review the current energy situation in North America. Out of global total

primary energy consumption (TPEC) of 12928 million tonnes of oil equivalent

(MTOE) in 2014, North America accounted for 2822 MTOE or 21.83%. The share of the USA was 18%, oil and gas

dominate with 67% (oil 36.3%, natural gas 30.7%), coal 17.3%, nuclear 7.65%, hydro

electric 5.4% and renewables 2.6% (Figure -1). Despite consuming oil and

natural gas fuels in bulk, its indigenous resource base is quite thin. For

example, it holds 232 billion barrels of oil reserves, a global share of 13.7%

and a life expectancy of 34 years. Natural gas reserves are at 429 TCF, 6.5% of

the global reserves with a life expectancy of 12.8 years. Coal stands at 245 billion tonnes with a global

share of 27.5% and a life expectancy of 248 years.

Figure-1:

North America Total Primary Energy Consumption by Fuel – 2014 (BP Statistical

Energy Review – 2014)

North America Resources

North America also holds enormous

unconventional shale oil and shale gas resources (Figures -2 & 3).

Technological advancement in horizontal drilling and hydraulic fracturing

allowed US to significantly increase shale oil and shale gas production. As a

result, US net oil import dependency

declined from 60% in 2007 to about 27% in 2014. Shale gas and renewable fuel (ethanol)

is expected to continue to penetrate the transport sector and industrial uses which

would help North America to reduce its

crude oil consumption in favor of natural gas and renewable fuel.

Figure-2: US Shale oil basins

Figure-3: US Shale gas plays

Source: Energy Information Administration (EIA)

North America Energy Demand

Outlook - 2040

North American energy demand is mainly driven by

respective energy prices, GDP and trend variables. Trend variables have been

used to capture technological advancements. The population though is an

important driver of energy demand and should be positively correlated, however

for North America it failed to explain energy behaviour and when included

distorted the other important explanatory variables like GDP is therefore

dropped. A number of models have been tested including static, Koyack and polynomial

distributed lag (Almon) model with varying degree of weights and lags to

capture the lag structure. The best estimated models for each of the energy

sources are selected and later re-run to forecast respective energy demand to

2040 under alternative scenarios.

Oil Demand Outlook - 2040

North American

oil demand is projected to decline over time due to penetration of NGVs,

electric and fuel cell cars in the transport sector as well as due to efficiency

gains. At the end of 2040, under the reference case North America is expected

to consume 894 MTOE (20.41 MMBD)

as compared to 1024 MTOE (23.34 MMBD) in 2014 see Figure -4. The reference case

is bounded by low and high case of 822 (18.76 MMBD) and 979 MTOE (22.34 MMBD). The

way the technology is developing transport sector, electric and fuel cells cars

in particular, it is quite possible that the share of oil in the North American

energy mix will decline from the current 36% to 20% at the end of 2040.

Figure-4: North America Oil Demand Outlook -2040

Source: Based on author’s econometric models & IEA

world Energy Outlook 2014

Natural Gas Demand Outlook - 2040

Unlike oil, natural gas demand is projected to

increase in North America. The reason being the region’s enormous

unconventional gas resources and the expected continuance of the shale gas boom.

Both the USA and Canada have aggressive plans to export natural gas in the form

of LNG to the global market. In

addition, consumption of natural gas in power generation increased,

particularly in the USA. Natural gas share in power generation went

up from 17% in 2001 to 27.4% again due to significant increase in US shale gas

production. North American natural gas demand under the reference

case is projected to increase from 866 MTOE in 2014 (949 BCM) in 2014 to 1083

MTOE (1192 BCM) at the end of 2040 Figure -5. The reference case is bounded by

low and high case of 994 (1093 BCM) and 1162 MTOE (1278 BCM) in 2040. We

anticipate a greater role for natural gas because it will capture a share in

power generation from coal and because of its growing importance in the transport

sector.

Figure-5:

North America Natural Gas Demand Outlook -2040

Source: Author’s econometric models and IEA World

energy Outlook 2014

Coal Demand Outlook - 2040

The contribution of coal is mostly associated with

power generation. However, the recent shale gas boom has reduced its role

particularly in the power generation. The contribution of

coal in US power generation for instance went down from 51% in 2001 to about

39% in 2014. While the share of natural gas in power generation went up from

17% in 2001 to 27.4% again due to significant increase in US shale gas

production. During 1980 to 2014, coal consumption increased from 413 MTOE in

1980 to 489 MTOE in 2014. However, due to strict environmental regulations and

availability of natural gas and energy renewable sources its role is expected

to shrink during next 2.5 decades. The model predicts that coal consumption is

projected to decline from 489 MTOE in 2014 to 332 MTOE in 2040 under the reference

case (Figure -6). The reference case is bounded by a low (298 MTOE) and a high

of (365 MTOE) in 2040. We have added another scenario which assumes if the very rigid environmental regulations

are imposed and technological advancement allow for the speedy penetration of

renewable sources. In this case we have used trend variable (T2). In this scenario

coal demand is projected to decline significantly to 120 MTOE.

Figure-6:

North America Coal Demand Outlook -2040

Source: Based on author’s econometric models and IEA

world energy Outlook 2014

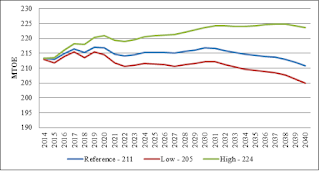

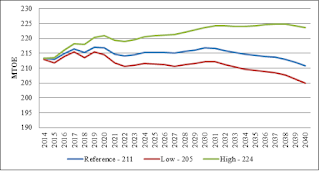

Nuclear Demand Outlook - 2040

Electricity demand is dependent on various factors –

GDP, prices, weather, however it is positively correlated with the economic

growth measured by GDP. During 1980 to 2014, the demand for nuclear energy

increased from 68 MTOE in 1980 to 216 MTOE in 2014 – an increase of 217%

(Figure -7). More than 94% of the variation in nuclear demand is explained by

GDP and electricity prices. GDP remains the main driver of electricity demand

as one percent increase in GDP will lead to 0.68 percent increase in nuclear

demand. Under the reference case nuclear demand is projected to decline from

216 MTOE in 2014 to 211 MTOE in 2040 due to efficiency losses and closure of some

of old nuclear plants. Reference case is bounded by low of 205 MTOE and high of

224 MTOE in 2040.

Figure-7: North America

Nuclear Demand Outlook -2040

Source: Based on author’s econometric models and IEA

world Energy Outlook 2014

Hydro Electricity Demand Outlook - 2040

Canada is the major producer and consumer of hydro

electricity in North America accounting for 56% of the regional hydro

electricity in 2014. The hydro electricity consumption increased from 118 MTOE

in 1980 to 154 MTOE in 2014 – an increase of 30%. Based on the model, hydro

electricity demand is surprisingly projected to decline during the 2014/2040 in

period probably due to decrease in the availability of hydro electricity or

model failed to explained the correct behaviour. Under the reference case it is

projected to decline from 154 MTOE in 2014 to 111 MTOE in 2040, in the low case

it further declines to 104 MTOE and for high economic growth it declines to 117

MTOE (Figure -8). The demand for hydro or electricity should be increasing

unless it is constrained by its availability or massive increase in renewables

– solar, fusion and wind.

Figure-8: North America

Hydro Demand Outlook -2040

Source: Based on author’s econometric models and IEA

world Energy Outlook 2014

Renewable Demand Outlook - 2040

The contribution

of renewables in the North American energy mix in 1980 was barely anything,

however, its contribution increased quite rapidly during the last decade. Despite

its significant growth, the contribution of renewables remained thin and stood

at less than 3% at the end of 2014. The contribution of renewables is expected to grow

rapidly during 2014 to 2040 due to: expected significant decline in cost of

wind, solar and other renewables due to technological advancements: utility

scale solar power generation capacity delivering a price below that of

coal/natural gas power plants; extensive use of solar panel in powering the

residential and office buildings; increase in the usage of ethanol in transport

sector and change of mind set of future generations to go green. However, it is

difficult to quantify these variables in our econometric models. We have to

continue to rely on GDP and electricity prices to model consumer’s behaviour,

though various other factors are important to explain the demand for renewable

sources of energy. We have assumed that the trend variable is expected to

capture the increasing availability of renewable sources at competitive prices

and we assume the trend variable to grow exponentially during the forecasting

period due to rapid technological advancements. The other important variables

are GDP and electricity prices. Based on our assumptions and model the demand

for renewable sources of energy under reference case is projected to increase

from 74 MTOE in 2014 to 362 MTOE in 2040– an increase of over 389%. The

reference case is bounded by a low of 264 MTOE and 653 MTOE a high case

scenarios (Figure -9). Figure -10 highlights some of the sources of renewables

that are expected to increase significantly during now and 2040.

Figure-9: North America

Renewables Demand Outlook -2040

Source: Based on author’s econometric models and IEA

world Energy Outlook 2014

Figure-10: Some

Sources of renewables expected to increase significantly

North America TPEC Outlook – 2040 (MTOE)

Table-1

provides a quick summary and comparison of North America TPEC outlook 2040 by

energy sources. The Authors forecast is

based on regional GDP growth, respective energy prices and trend variables.

What message can we draw from this analysis? The news and academic papers reports about the important

role of renewable sources in TPEC mix. However, based on the forecast, the

message is quite clear that the role of fossil fuels most likely will remain

the dominant sources of energies in North America despite significant growth in

renewable sources. Based on authors

forecast the share of fossil fuels remains between 71% and 78%. It is quite

possible that the share of fossil fuels particularly that of oil may decline

from current 36% to 20% by 2040. This lost share will be captured by renewable.

Therefore, it is quite possible that the contribution of renewables may further

increase, nearing our high case scenario. Especially considering various car

companies are in the process of bringing fuel cell and electric cars to market.

In fact, Toyota already started selling the

world’s first mass market fuel-cell car in Japan in 2014 - the four-door Mirai.

The auto giant is hoping to build on the success of its popular

gasoline-electric hybrid Prius to sell tens of thousands of the eco-friendly Mirai over the next decade, as it looks to stop

producing fossil-fuel based cars altogether by 2050. Honda’s rival Clarity

Fuel-Cell vehicle features a cruising range of more than 700 kilometers (430

miles), which it claims is the longest on the market, and can store enough

power to supply an average household’s energy needs for a week. As far as solar

energy is concerned its cost has reduced significantly. According

to Lawrence Berkeley National Laboratory, who conducted the report, installed

project costs have fallen by more than 50% since 2009, from about $6.3/W in

2009 to $3.1/W for projects completed in 2014.

We believe that the contribution of

renewables most likely to remain between 9% and 12% for low and reference case

scenarios, however in the extreme high its contribution may increase to about

19% based on model predictions. In our opinion the high contribution of

renewables in the energy mix is highly dependent on timing and availability of

fusion electricity which is still in its research stages, and efforts are being

made to produce electricity on commercial scales. If fusion electricity is

available during the projection period then it is quite possible that the role renewables

will increase to 19% or even more otherwise its contribution will most likely

remain under 12%.

Good news for oil and gas industry

Our

long-term North American energy demand forecast highlights that the

contribution of fossil fuels under alternative scenarios, particularly that of

oil and gas are likely to remain the major driver of North American economy.

However, oil and gas companies should also prepare and develop alternative

strategies in case rapid penetration of renewable in transport and power

generation takes place earlier than 2030.

Table-1: North American TPEC

outlook 2040 - comparison

Appendix-A:

GDP and population growth assumptions (%)