Ever since the invention of internal combustion engine (ICEs) way back in the early 1900s, the demand for cars has continuously been on the rise. The new way of transportation not only made mobility of people easy and faster (compared to horse-coaches), but also represented a major driver for the oil industry.

Today about 70 percent of oil is consumed in transportation sector – road, air, rail, sea. Bulk however, is associated with road transportation. At the end of 2015, the total number of ICEs vehicles increased to 1.2 billion, representing about 60 percent of total global oil demand. The major drivers of global oil demand has been associated with economic growth, population growth and oil prices. Therefore, these factors are always critical in oil and gas companies’ investment decision making process apart from other technical and uncertain parameters.

If oil and gas companies perceive higher demand and higher oil prices over the longer horizon irrespective of what oil prices are today, they opt to make capital investments in upstream business, even in high-cost projects, as the obvious reason is to achieve their corporate objectives of growth and profitability.

We have jotted down the forecasts of the Energy Information Administration (EIA), International Energy Agency (IEA) and BP energy outlooks for various years for which data is available.

Global oil demand and oil price outlook from EIA’s point of view

The data on global oil demand and oil prices were gathered from the EIA Annual Energy Outlook (AEO) and International Energy Outlook (IEO).

The EIA anticipates that global oil demand will continue to grow, reaching around 121 million barrels daily (mmbd) in its reference case in 2040. Interestingly enough, despite significant changes that are taking place in global energy landscape like penetration of electric vehicles (EVs) and the rapidly increasing role of natural gas and renewables, EIA did not change their oil demand outlook. In fact, in each of the succeeding years their oil demand outlook became stronger and stronger. The reason being that EIA probably still believes that the penetration of EVs and renewable may not have significant impact on global landscape in the years to come in contrast to many other analysts.

The EIA long-term reference oil price forecast also depicts that over the longer horizon the oil market is likely to remain tight and therefore, oil prices will continue to rise. Were the EIA’s oil demand scenario’s to become reality, this would be good news for oil and gas industry as it will motivate them to continue to invest in upstream and downstream businesses.

Global oil demand outlook from IEA prism

In contrast to a bullish EIA, the International Energy Agency is sensing the greater element of uncertainty as they formulated three types of scenarios. Current, New Policies and the 450-Scenario.

As far as Current Policies are concerned, IEA’s thinking is align with the EIA. Oil demand continues to grow strongly reaching about 121 mmbd in 2040. While in the New Policies Scenario, oil demand continues to grow steadily, reaching about 107.7 mmbd in 2040. Under New Policies Scenario, IEA anticipates that a combination of policy action to promote more efficient oil use and switching to other fuels and higher prices will partially offset the global oil demand as compared to current Policies.

In its 450-Scenario, IEA strongly believes in a successful implementation of the Paris agreement on climate change. It finds that the era of fossil fuels appears far from over and underscores the challenge of reaching more ambitious climate goals. IEA in their 450-scenario (2016) predicts that oil demand will go down to 74.1 mmbd in 2040, 2.2 mmbd higher than they projected in 2015.

Global oil demand outlook from the BP prism

Up until 2016, BP analyses wasn’t that different from the EIA’s and IEA’s as far as global oil demand is concerned. In their 2017 report, the company reduced its global demand outlook to 106 mmbd in 2035 as compared to its 2016 projection of 112 mmbd. In its 2017 report, the company takes into consideration the penetration of EVs. It believes that by 2035 total number of EVs would reach to around 100 million displacing 1.2 mmbd of oil.

What can oil companies learn from this analysis?

Oil company management should be open minded, looking around as to what is happening both within and outside of the industry, in particular the auto-industry and renewables sector. The reason being that lion share of oil demand is associated with the transport sector. Any innovation whether in terms of efficiency or market penetration of electric, natural gas, hybrid or fuel cells, autonomous powered vehicles could displace significant amounts of global oil demand.

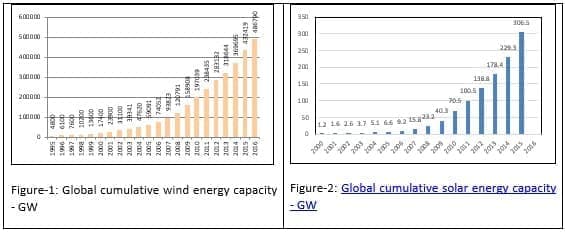

Additionally, the rise of renewable energy is no secret, the cost of wind and solar energy came down drastically in recent years. According to investment bank Lazard, the cost of renewable energy has decreased dramatically since 2009, in the case of utility-scale solar by 85 percent and in the case of wind power by 66 percent. Consequently, in certain environments, renewable energy is already cheaper than electricity from conventional coal or gas plants.

Global Primary Energy Mix under New Paradigm?

In 2000, oil was the dominant source in the global primary energy mix, accounting for 38.7 percent, followed by coal 24.4 percent, natural gas 23.7 percent, hydro – 6.78 percent and nuclear 6.43 percent. During the last one and a half decade, the share of oil slipped to 32.94 percent, while coal increased to 29.2 percent, natural gas and hydro respectively marginally up to 23.85 percent and 6.79 percent while renewables emerge as new form of primary energy stood at 2.78 percent in 2015.

Source: BP Statistical Review of World Energy June 2002 and June 2016

Rational of this Paradigm shift

In my personal view the role of fossil fuels will grow smaller in the next 2-1/2 decades from 86 percent in 2015 to 66 percent in 2040 due to penetration of renewables as the world is moving fast to implement the Paris accord on climate change. The role of oil and coal respectively is likely to plunge to 20 percent and 18 percent in 2040. While the clear winner would be more environmentally friendly natural gas and renewables. Natural gas and renewables (solar and wind) in particular will be substituting coal in power generation. By 2040, the share of natural gas will climb up to 28 percent, nuclear 6 percent, hydro 7 percent and renewables will see the most significant increase: to 21 percent.

(Click to enlarge)

Source: BP Statistical Review of World Energy June 2002, June 2016 and Author’s.

In my opinion BP’s and IEA’s new policies scenario are still conservative. I strongly believe that the penetration of EV’s, efficiency, natural gas vehicles, hybrid or fuel cells, electric autonomous vehicles, biofuels and renewables are expected change the energy market faster than many may think. A recent study by the Boston Consulting Group (BCG) concluded that by 2030, a quarter of all miles driven in the U.S. will most likely be in autonomous vehicles. In recently published article by Jillian Ambrose "Why the market for fossil fuels is all burnt out?” highlights the thought process of Dr. Prof Dieter Helm who strongly believes that the era of expensive oil is over and in fact the demand for oil will further diminish with fast penetration of electric vehicles (EVs) and driverless vehicles. Another energy futurist, Andreas de Vries, recently published an article titled “Wake up call for oil companies: electric vehicles will deflate oil demand”, in which he predicted that under the reference case the penetration of EV’s, natural gas vehicles, hybrid-vehicles will displace 13.8 mmbd by 2040. According to Bloomberg New Energy Finance’s (BNEF) study, EVs will increase global electricity demand by 8 percent – reflecting another forecast from BNEF that EV’s will represent 35 percent of new light-duty vehicle sales in 2040. We strongly believe that these autonomous cars as well as non-autonomous cars would be electric vehicles. As a result, we believe displacement of about 14 to 39 mmbd in 2040 is to take place due to penetration of EVs, NGVs and fuel cell vehicles. This view is significantly different than the view that EIA and BP’s have, however it aligns with the IEA 450 scenario.

Higher investment in oil exploration in anticipation of increasing global demand might not bear fruit in the decades to come as the automotive industry is rapidly moving away from internal combustion engines.

Concluding, oil and gas industry should be cautious and keep an eye on the changing dynamics of the automotive and renewable industries while formulating long-term strategies and investment decisions.

By Salman Ghouri for Oilprice.com